child tax credit october 15 2021

Checks will be sent out from October 15 and should arrive in bank accounts within days. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

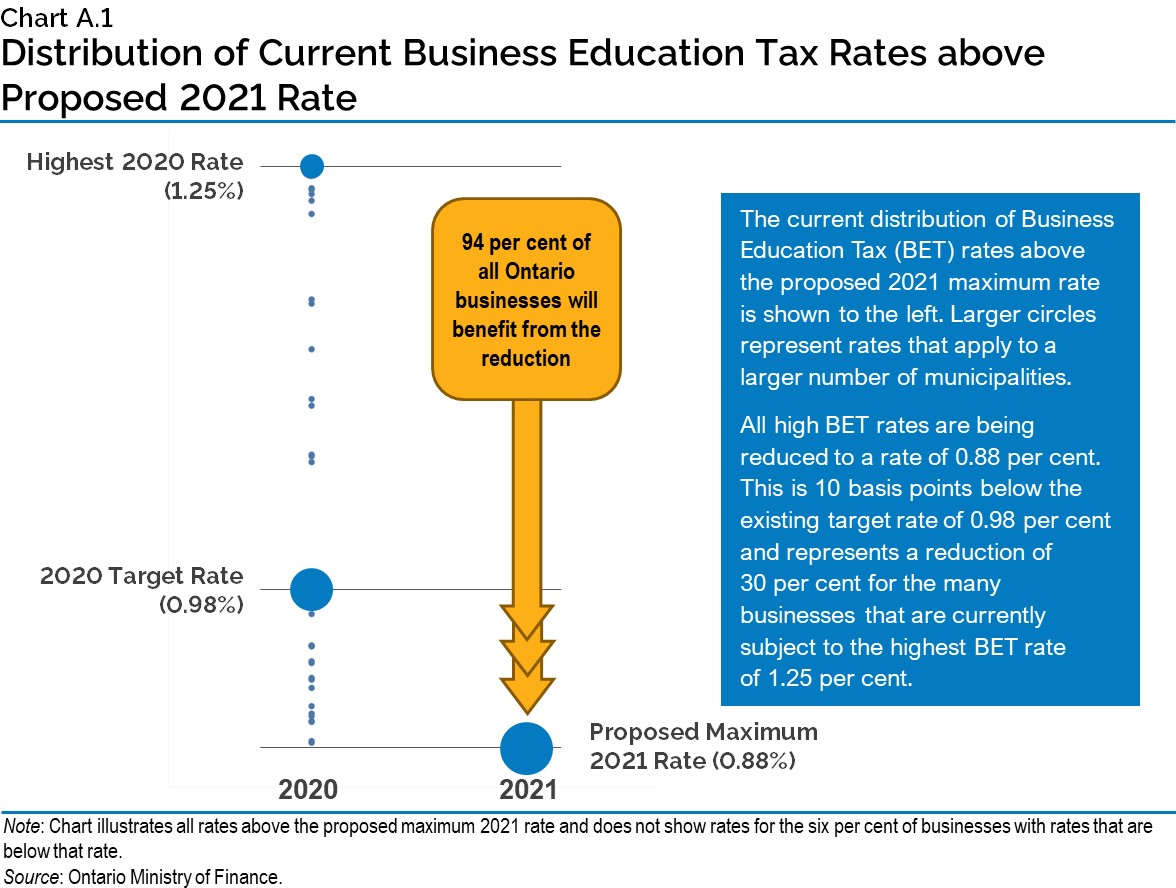

Chapter 2 The Road To Recovery Efu 2021

October 15 Deadline Approaches for Advance Child Tax Credit.

. The 2021 CTC will be reduced in two steps. Under the American Rescue Plan the child tax credit was expanded for the 2021 tax year to a total of 3600 for children 5 and younger and 3000 for those 6 through 17. October 14 2021 559 PM CBS Baltimore.

Child Tax Credit Norm Elrod. IR-2021-201 October 15 2021. Ad Discover trends and view interactive analysis of child care and early education in the US.

Ad The new advance Child Tax Credit is based on your previously filed tax return. Starting with the October payments the individuals who received those payments approximately 220 000 people will stop receiving payments. The final two payments for 2021 are due November 15 and December 15.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. Thats an increase from the regular child tax. So parents of a child under six receive 300 per month and parents of a child six or.

For 2021 eligible parents or guardians can receive up to 3600 for each child who. PAYMENTS worth around 15billion are set to be sent out to American families next month. How much will my 2021 Child Tax Credit amount decrease by if I have a higher income.

The child tax credit scheme was expanded to 3600 from 2000 earlier this year. CBS Detroit The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. For qualifying children claimed. As you may know the American Rescue Plan dramatically expanded the Child Tax Credit CTC to a maximum of.

The cash will come in the form child tax credits due to arrive in bank accounts on. CBS Detroit -- The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

Thats an increase from the regular child tax. The CTC will be reduced to 2000 per. October 14 2021 at 559 pm.

Get the up-to-date data and facts from USAFacts a nonpartisan source. The advance is 50 of your child tax credit with the rest claimed on next years return. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. The IRS will send out the next round of child tax credit payments on October 15.

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

2022 Tax Deadlines And Extensions For Americans Abroad

2022 Public Service Pay Calendar Canada Ca

What Is The Child Tax Credit For 2021 Credit Karma

2022 Tax Deadlines And Extensions For Americans Abroad

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

Child Tax Credit 2021 8 Things You Need To Know District Capital

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

The Advance Child Tax Credit Changes Coming

Tax Return Deadlines 2021 Tax Deadline Tax Return Deadline Tax Refund

2021 Child Tax Credit Advance Payments Claim Advctc

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

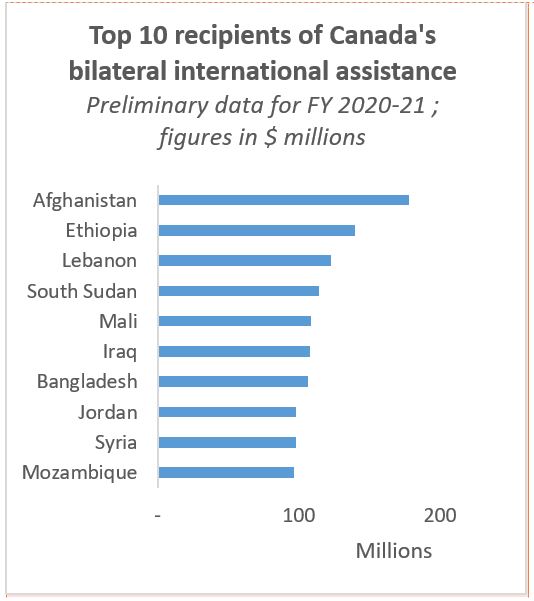

Minister Of International Development Briefing Book